When it comes time to turn a lifetime of diligent savings into a reliable income stream, you’ll want to know your money is secure without giving up on the prospect of long-term growth that offsets inflation.

You can attain these goals using a cash wedge strategy with IPC. With a cash wedge strategy, you can:

- Withdraw secure and predictable income from a secured investment to maintain your current lifestyle.

- Continue to grow your retirement nest egg to provide ongoing growth potential.

- Maintain your peace of mind knowing you can access your money when you need it.

Here’s how it works:

1. Allocate 1-3 year's worth of income in a "cash-wedge" - typically a low-risk investment such as IPC's High Interest Savings Fund. The remainder of your savings is invested in a balanced income solution like IPC's Global Income & Growth Portfolio for providing income and long-term growth.

2. Next, your advisor sets up a systematic withdrawal plan that provides you with regular monthly income payments from the cash wedge.

3. As you withdraw regular income payments, the cash wedge is automatically replenished with income distributions from IPC Income & Growth Portfolio to ensure you always have 1-3 year's worth of income in a conservative investment.

Two Solutions Working Together to Provide Dependable Income

IPC High-Interest Savings Fund for Your Cash Wedge

The IPC High Interest Savings Fund invests in cash deposits which provides it with a competitive interest rate on cash balances1. It is a low-risk investment solution designed to meet your short-term income requirements and offers a compelling alternative to a traditional savings account or Guaranteed Investment Certificates (GICs).**

With the flexibility to withdraw your money at any time, the IPC High Interest Savings Fund is an ideal investment for delivering regular monthly income payments from a cash-wedge strategy.

IPC Global Income & Growth Portfolio for your Balanced Income Solution

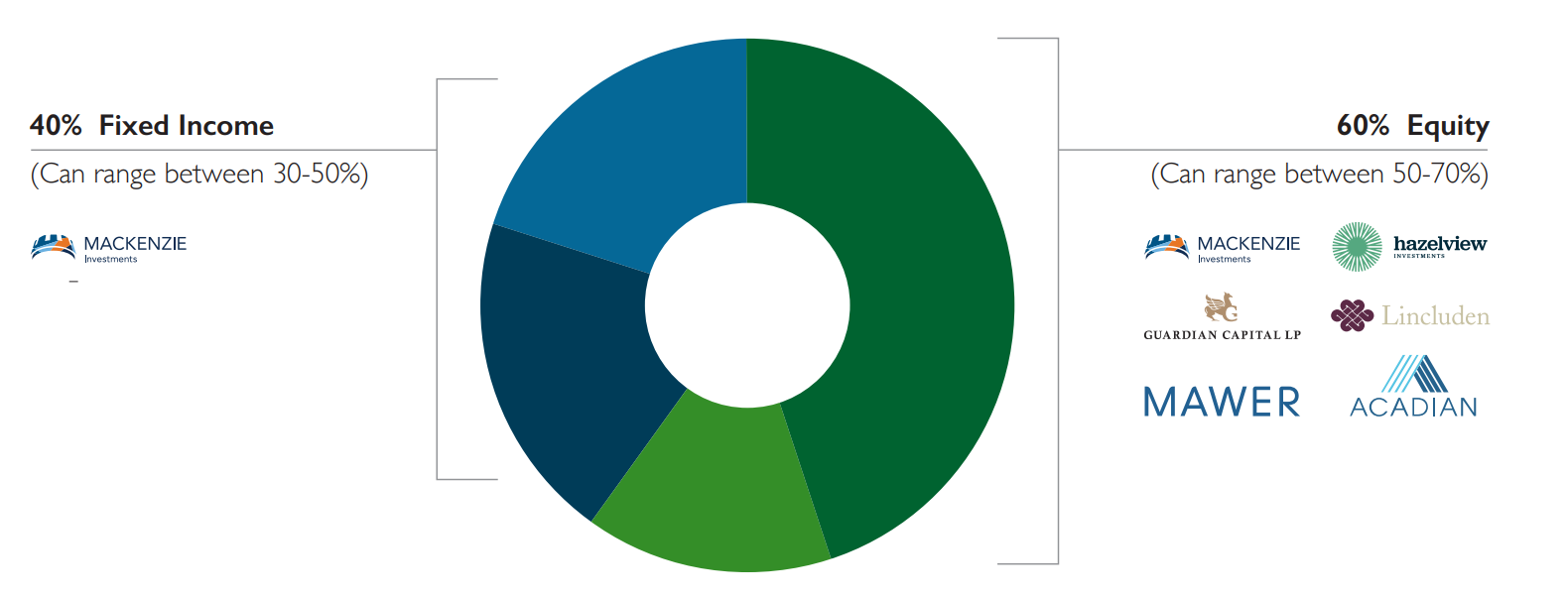

With higher interest rates due to persistent inflation causing more volatility in stock markets, you need a well-diversified solution that provides income from multiple sources along with total return potential. For the core of your cash wedge strategy, we recommend IPC Global Income & Growth Portfolio to provide you with those diversified sources of income and the potential for long-term growth:

- A blend of equities, fixed income, and alternative assets to provide diversified return sources through price growth and income generation.

- Multiple income sources that include Canadian and global dividends, higher-yielding fixed income, global real estate, and liquid alternatives.

- Concentrated equity strategies for growth to ensure your long-term capital continues to grow to offset inflation.

Minimize Your Retirement Income Risk

Implementing a cash wedge strategy by combining a long-term solution, such as IPC’s Global Income & Growth Portfolio, with IPC’s High Interest Savings Fund, can help you minimize the effects of short-term market volatility while ensuring your longer-term funds can still grow for the future.

Talk to us today to learn how implementing a cash wedge strategy using the IPC Global Income & Growth Portfolio and the IPC High Interest Savings Fund can help you achieve your long-term investment goals.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the Simplified Prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Trademarks owned by Investment Planning Counsel Inc. and licensed to its subsidiary corporations. Investment Planning Counsel is a fully integrated Wealth Management Company. Mutual Funds available through IPC Investment Corporation and IPC Securities Corporation. Securities available through IPC Securities Corporation, a member of the Canadian Investor Protection Fund (CIPF). *Interest is calculated daily on the total closing balance in the Fund’s investments on each day and paid monthly. The effective interest rate paid to unitholders may vary from the gross rate provided to the Fund depending on multiple factors including the fees of the series purchased, the settlement date of the purchase and the growth rate of the fund. **Unlike mutual funds, the returns and principal of GICs are guaranteed. The IPC High Interest Savings Fund is not Canada Deposit Insurance Corporation (CDIC) insured.

Investment Planning Counsel