The end of the summer holidays for many of us represents new beginnings and opportunities.

For those of us with children, the start of a new school year. Cooler mornings hint at the changing seasons and the onset of Fall, my favourite time of year. And of course, this year included a Federal election. This won’t be a commentary on the implications of Canadian politics as I believe there are more significant forces that have implications to your portfolio than whether the Liberals or the Conservatives are the governing party.

If I were to sum up the developments in the global economy, the headline would read: The results are not entirely encouraging. But you should always read beyond the headlines, as context and nuance are always key.

The most obvious place to start is with the latest economic data, which point to a slowdown in the pace of recovery across the world’s major economies. This was most evident in U.S. payrolls data for August. But everything from the manufacturing PMIs [1] to data on retail sales suggests that growth slowed over the summer. One-off misses can be dismissed at first as noise, but a series of misses becomes a trend, and it is now clear that economic recoveries in the Canada, U.S., U.K., Euro-zone, and China have lost steam in recent months.

A slowdown in growth was inevitable given that impressive rebounds in the first half of the year left most economies either at or close to, their pre-virus levels of output.

The low-hanging fruit of this recovery has been picked, but there is growing evidence that supply constraints are now weighing on activity in some consumer goods sectors. In our household, this has become particularly evident as our two-year-old freezer has broken down and requires a new circuit board and we are told that we are looking at a four-to-six-month delivery time…yikes! Luckily, I still had my 30+-year-old chest freezer from my university days, and we quickly put it back into service. For those of you who have looked to purchase a new car recently, the lack of supply and choice is a result of the semiconductor shortages that constrain supply. The rapid spread of the highly contagious Delta coronavirus variant has also played a part in slowing economic growth, too.

COVIDs effects have been particularly severe in countries where governments are still pursuing zero-COVID strategies, most notably China. The fact that the Delta variant continued to spread – albeit much more slowly – among highly vaccinated populations meant that governments in these countries had to reinstate movement restrictions to suppress further transmission of the virus. The result is a renewed hit to economic activity, particularly in COVID-sensitive parts of the service sector such as leisure and hospitality.

Delta has also affected output – albeit to a much smaller extent – in countries with a less stringent approach to containing the virus, including the U.S. and the U.K. This is because, while governments have resisted reimposing new lockdowns, the surge in Delta cases has caused individuals to reduce their activities voluntarily. If nothing else, this serves as a reminder that the ebb and flow of the virus will continue to have a significant bearing on the pace of the recovery, and that there are likely to be more bumps in the road ahead.

On Inflation

While data on activity and output surprised on the downside, inflation data have generally surprised on the upside, with inflation now running above target in the U.S. and the Euro-zone.

Once we delve into the details, we see that 90% of the increase in inflation can still be attributed to effects of the pandemic that are likely to be temporary.

This includes a sharp rebound in global commodity prices, and also an increase in the prices of everything from used autos to airline tickets and restaurant meals. The good news is that there are signs in the latest data that we’ve passed the peak of pandemic-related “re-opening” inflation. We continue to expect inflation in all major economies to drop back in 2022.

All of this has created something of a headache for central bankers as growth slows and inflation rises. Central banks are grappling with how to reduce their stimulus packages in an environment where supply-chain bottlenecks and labour market mismatches are complicating their jobs. The learnings from COVID so far are that spending pivots from services to goods when pandemic fears escalate. Yet, as I noted earlier, there is now growing evidence of supply constraints in goods production, making it more likely that continued government support in the face of renewed virus concerns only serves to push up prices rather than stimulating output.

The bottom line is that central banks find themselves in an impossible situation: attempting to sustain economic recoveries in the face of Delta fears while at the same time maintaining their commitment to monetary and financial stability against a backdrop of elevated inflation and high and rising asset prices.

And, to compound matters, they are doing all of this with a set of policy tools that have become less effective at supporting output in the real economy.

The big question is what comes next. The most likely outcome is that the global recovery continues, albeit at a slower pace, that inflation peaks in the coming quarters before dropping back next year, and that central banks dial back policy support in a gradual manner. But, compared to the start of the summer, the landscape that policymakers will have to negotiate has become significantly more difficult.

On Market Valuations

We see long-term bond yields rising across most major economies, especially in the U.S., where we think inflationary pressures are particularly strong. As a result, higher yields will limit the upside for risky assets like equities. At the moment, equity valuations already appear fairly high in many cases, like in the U.S. As we indicated in our July commentary Setback or Derailment of the Recovery,

the extremely strong rebound in corporate earnings already appears to be discounted and, as a result, we forecast only small gains in equities across both developed and emerging markets and expect corporate credit spreads to narrow only a little, if at all, from here.

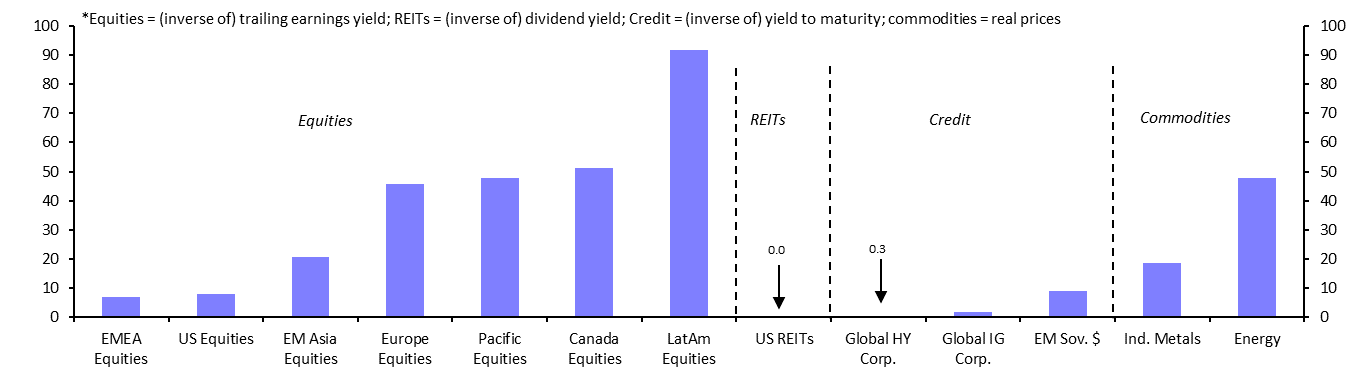

However, forecasting future returns is a tricky proposition, as valuation measurement is not a great timing indicator, but there is still value in the forecasting as it puts into context how much you are paying for future earnings and the potential opportunities and risks built into those valuations. We could go into various valuation measures and have a lengthy discussion on them but to be brief, let’s look at two of them, one that we prefer and another that is popular but circumspect. One of our preferred views is to look at the percentage of times that various equity markets have been more expensive than they are today. We can see from the below chart that many asset classes have only been as expensive as they are today for less than 10% of the time. U.S. equities stand out, especially when compared to their global peers.

Source: Capital Economics

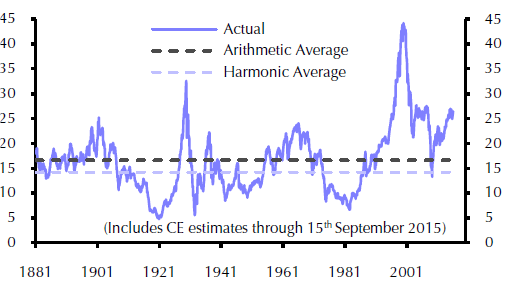

A popular measure is looking at the well-known Shiller Ratio of cyclically adjusted price to earnings, a measure of a market’s over/undervaluation vs it’s long-term average. By this measure, we see that current valuations of U.S. equities are at ~24.9 vs. the Harmonic average of 14.2, indicating a significant overvaluation. However, we would not put too much stock in this measure as it grossly overstates the relative valuation.

Source: Capital Economics

To summarize, we expect the economic recovery to continue to march forward, albeit at a slower pace.

Inflation has generally surprised on the upside, but once we delve into the details, we see that most of the increase can still be attributed to effects of the pandemic that are likely to be temporary. Equity valuations already appear fairly high in many cases, and when it comes to risky assets, a great deal of optimism already seems to be discounted in the current price. The extremely strong rebound in corporate earnings also appears to be discounted. As a result, we forecast only small gains for equities across both developed and emerging markets and expect corporate credit spreads to narrow only a little from here, if at all. As a result, the easy pickings have been had. We encourage investors to temper their expectations and review the amount of risk they are taking in their portfolios.

As always, we encourage you to follow a sound financial plan and speak with your Advisor to ensure you are on track to meeting your investment objectives.

Sincerely,

Corrado Tiralongo,

Chief Investment Officer

Counsel Portfolio Services | IPC Private Wealth

Click Here to Read Our Forward-Looking Statements Disclaimer

[1] A Purchasing Managers' Index or PMI is an economic indicator, which is derived after monthly surveys of different companies. The index shows trends in both the manufacturing and services sector.

Investment Planning Counsel