In Roger Gibson’s practical guide to strategic asset allocation of investment portfolios, he references the ancient Jewish Talmud records dating as far back as 1200 BC, which said,

“Let every man divide his money into three parts, and invest a third in land, a third in business and a third let him keep by him in reserve.”

In modern parlance, Gibson equates land with REITs (or real estate), business with US stocks (equities), and reserve as US bonds (fixed income). This simple asset allocation scheme would have passed the test of time, with all three assets generally providing long-term positive returns while giving investors the much sought-after benefit of diversification.

In the current day, we have fallen into a simplified doctrine of the 60-40 portfolio, 60% stocks and 40% bonds. This norm, which in prior decades was tested as the optimal portfolio for the average investor, has generally stood the test of time, ubiquitously now being called the ‘balanced portfolio’.

Since the 2000s, the balanced portfolio has worked well. Stocks and bonds have been in an extended bull market and during periods when stock prices have retreated, the bond portfolio has provided safety and the much-needed diversification that investors seek.

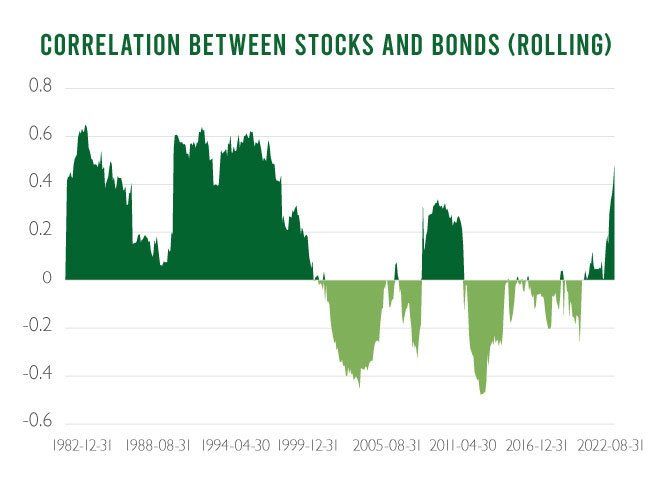

Figure 1: Source: Source: Morningstar Direct. Rolling 3 Years window, 1 month shift. Bonds: Bloomberg US Agg Bond TR USD, Stocks: Russell 1000 TR USD

Could it be that the holy grail of diversification had been achieved, with perfect diversification benefits, as shown in Figure 1 above, with, until very recently, negative correlation between US stocks and bonds, during a secular bull market for both stocks and bonds?

Alas, 2022 has tested that belief, with both stocks and bonds unexpectedly dropping, and pushing correlations into positive[1] territory - the dreaded one-two punch of negative returns and zero diversification benefits. Even before this year, critics of the 60-40 portfolio were questioning the low interest environment’s effects on the income-side of the portfolio, and whether it would provide enough diversification against risk assets.

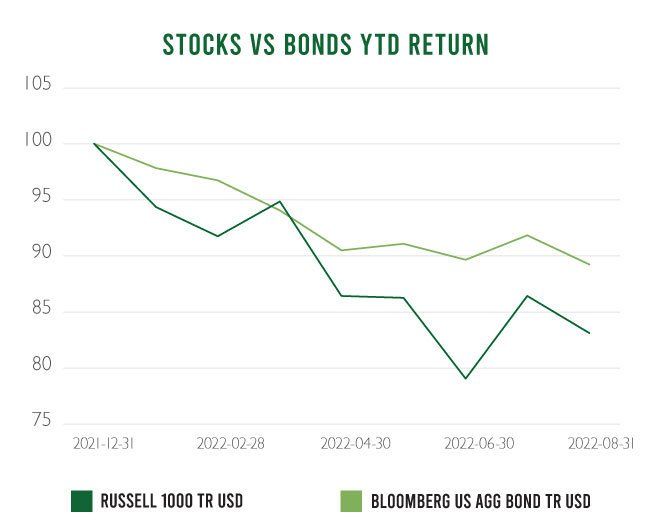

Figure 2: Source: Morningstar Direct

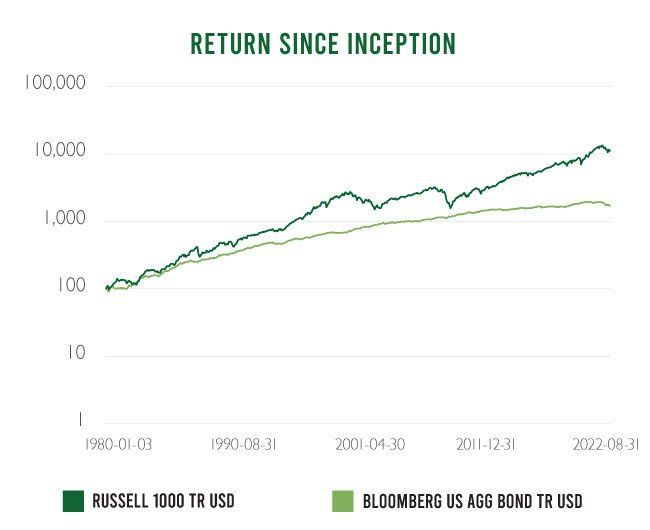

So, is the solution to forget about bonds, as they provide no downside protection during an inflationary environment? And, if one has a long-enough timeframe (see Figure 3 below), don’t they underperform stocks anyways?

Figure 3: Source: Morningstar Direct

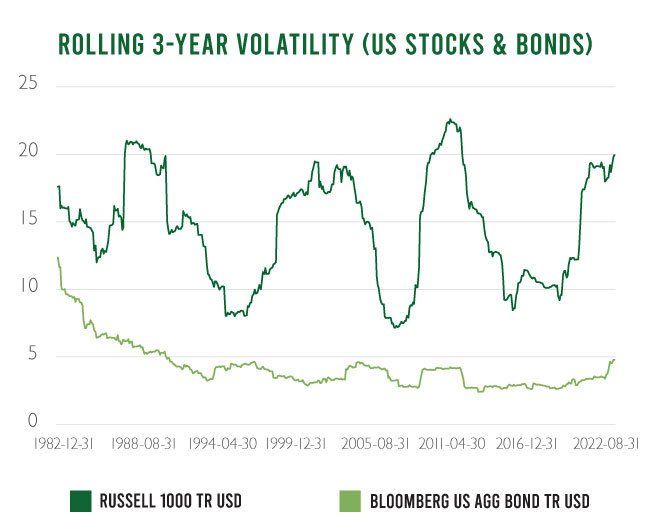

I would argue no, that there are still two key benefits to mixing bonds into your portfolio that go beyond correlation alone. The first is that bonds, even in the current environment, will lower the volatility (annualized standard deviation) of your portfolio, as shown in Figure 4 below.

Figure 4: Source: Morningstar Direct. Rolling 3 Years window, 1 month shift

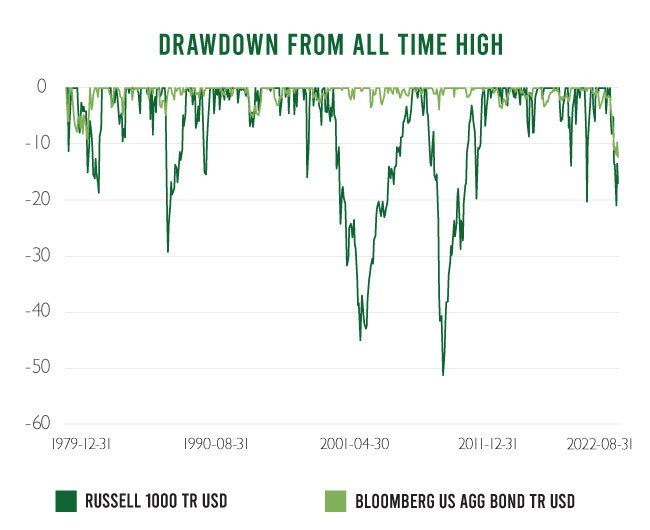

The second reason is for protection. Even with bonds having historically negative performance this year, they still have provided more stability than stocks in terms of their drawdown performance as seen in Figure 5 below. Having a 60-40 portfolio may not have fully protected your portfolio from overall negative performance this year, but it has certainly cushioned the blow.

Figure 5: Source: Morningstar Direct. Rolling 3 Years window, 1 month shift

In conclusion, the reason you fundamentally want to own bonds is the same reason they will inevitably find their way into a balanced portfolio. If you had an infinite investment horizon and no need to consider periodic withdrawals, then you could, in theory, only need to care about the appreciation side of your portfolio. We know that most investors are not in that position, and so there is still a strong case to be made to balance your portfolio accordingly – for both lower volatility and protection.

Investment Planning Counsel