For investors, capital preservation and a steady income stream are key benefits of having an allocation to fixed-income investments.

But how can you reduce risk amid uncertainty about interest rate trends?

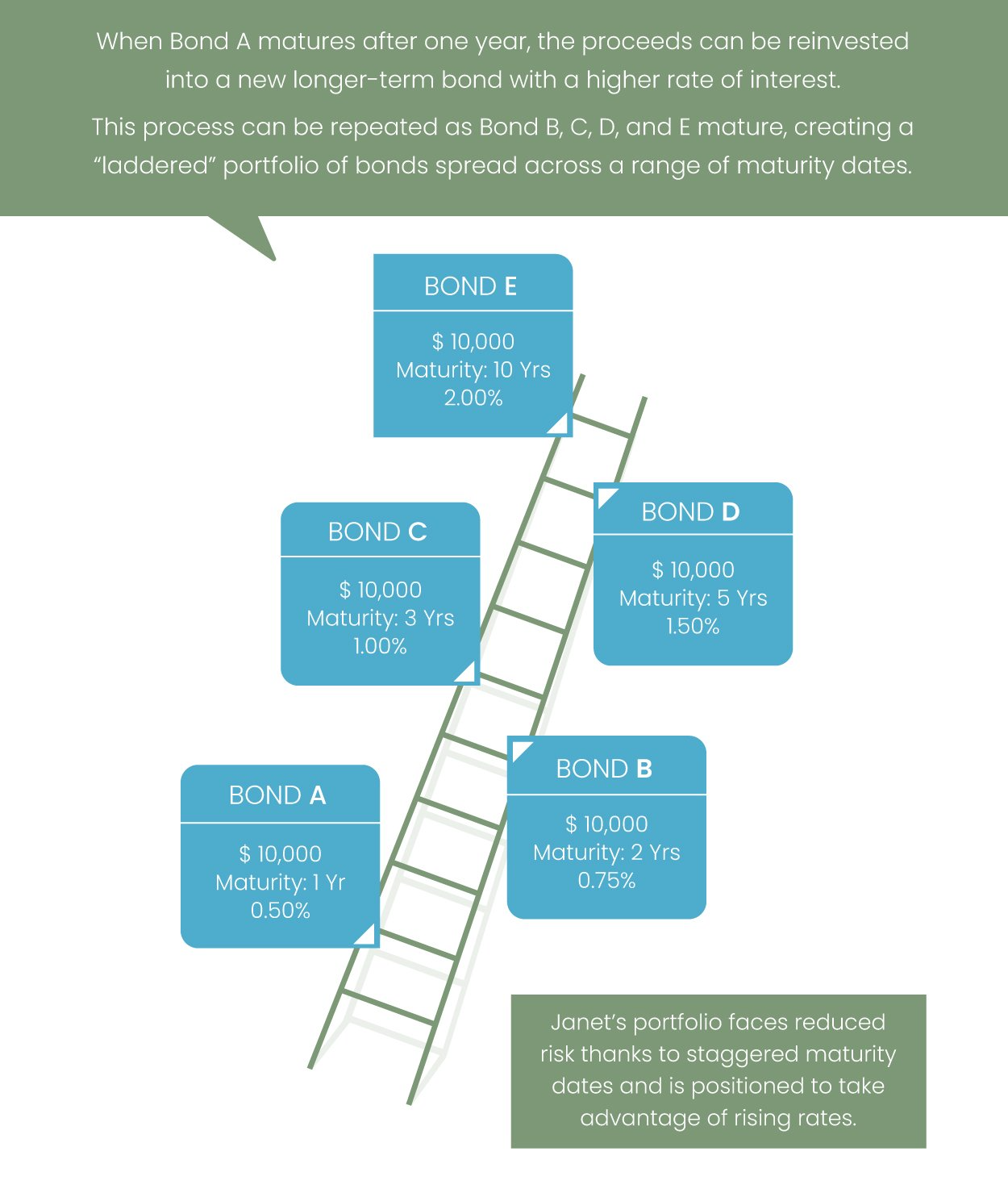

With a Bond Ladder strategy.

Benefits of a Bond Ladder

A Bond Ladder is a structured portfolio of bonds that mature at different times in the future.

- Capital Preservation – Offsets uncertainty from changing interest rates with a diversified portfolio of bonds maturing over the short, medium, and long term.

- Potential for higher yields – Benefits from rising interest rates by seizing opportunities to reinvest when interest rates rise.

How a Bond Ladder Strategy Works

- Janet has a balanced portfolio with approximately 40% allocated to fixed income

- Interest rates are currently rising

Janet’s advisor recommends a portfolio that uses a core Laddered Bond strategy complemented by an allocation to High Yield and Emerging Markets Fixed Income securities. The core Bond Ladder portion is invested in a concentrated set of bonds with five different maturity dates.

Interested in a sophisticated portfolio that can benefit from a Laddered Bond strategy? Ask us about IPC Private Wealth Visio Pools.

Visio Pools provide access to concentrated portfolios of the best investment ideas from top-ranked asset managers carefully selected for their specific areas of expertise. The result is portfolios that are lower cost, easier to monitor and understand, and optimized to achieve your financial objectives.

Investment Planning Counsel