As investors, we seek to build diversified equity exposure with the objective of achieving higher returns with lower risk profiles and better diversification than broad equity markets.

We seek to do that by employing a broad array of strategies depending on the type of outcomes that we are looking to achieve for investors. Multi-factor strategies are one of the tools that we utilize, as they offer the potential for long-term attractive performance and diversification benefits compared to traditional cap-weighted or style-based equity solutions.

What are Factors?

A “Factor” is a generic term for characteristics of stocks that provide a common source of return across a broad universe of equity securities. For example, the Value factor identifies equities that are inexpensive relative to the broad market, while the Momentum factor identifies equities that have experienced recent persistent price acceleration. We are interested in factors because they are an identifiable source of returns common to both passive and active strategies. By isolating their exposure in our portfolios, we can target the return potential from any of the factors much more effectively.

“There is no free lunch attached to factor investing.”

There are just six factors that are considered robust in that they generate a long-term risk premium. There are many other published factors and factor strategies developed over the years, however, almost all of them are based on data mining and/or themes that lack robustness. The criteria used to determine if a set of characteristics constitute an actual robust factor include:

- The factor is grounded in academic literature and vetted through the scientific method over decades;

- The factor is robust across definitions and geographies;

- The factor has a credible, economic rationale to offer a persistent risk-adjusted return premium.

The six common consensual factors that decades of research have shown to have the potential to deliver excess returns are:

- Value

- Low Volatility

- High Momentum

- Low Investment

- High Profitability

- Market Cap Size

“Diversification across factors has historically reduced the length of periods of underperformance by any one individual factor.”

Figure 1: The Six Factors

Source: Counsel Portfolio Services

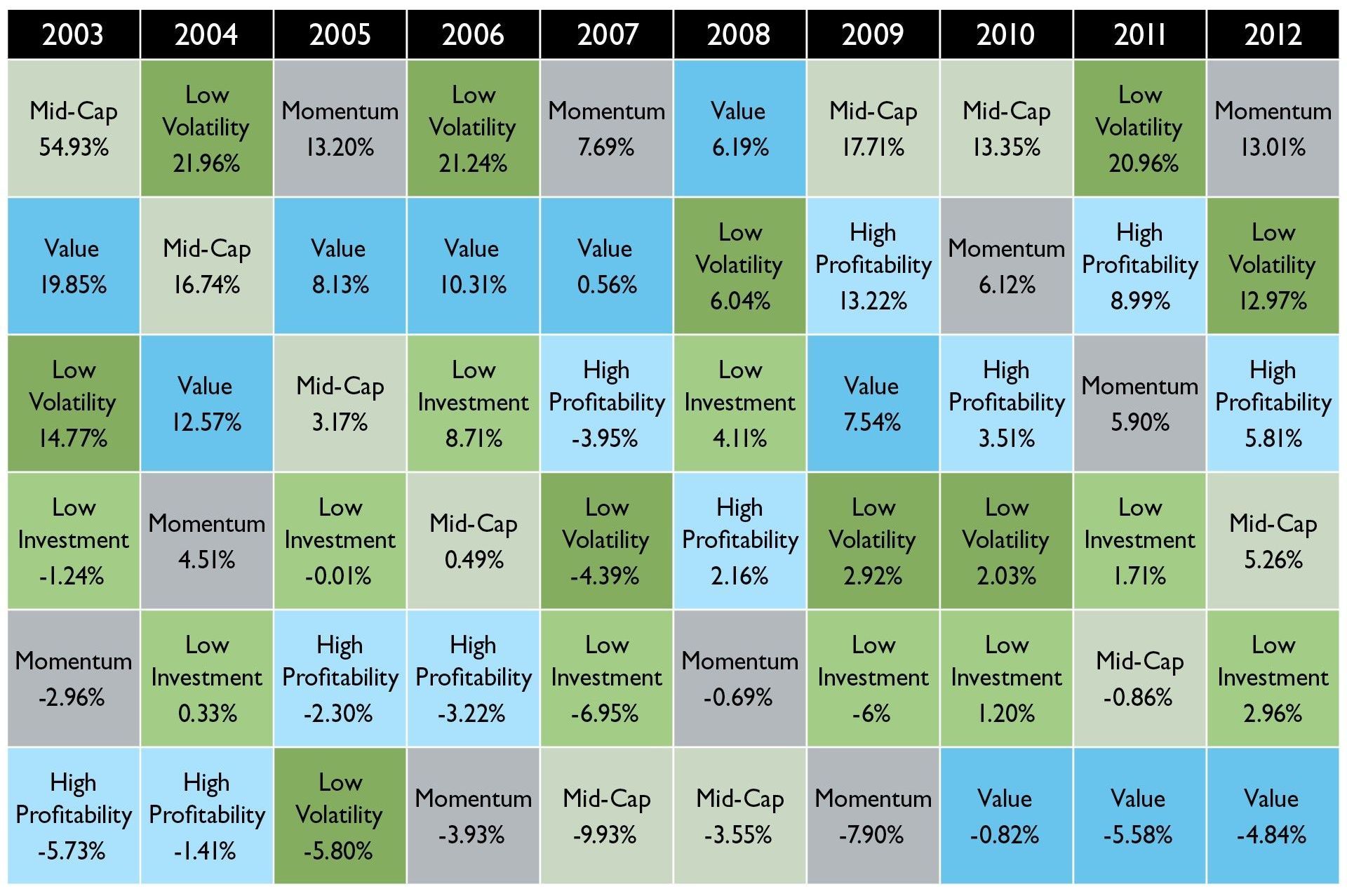

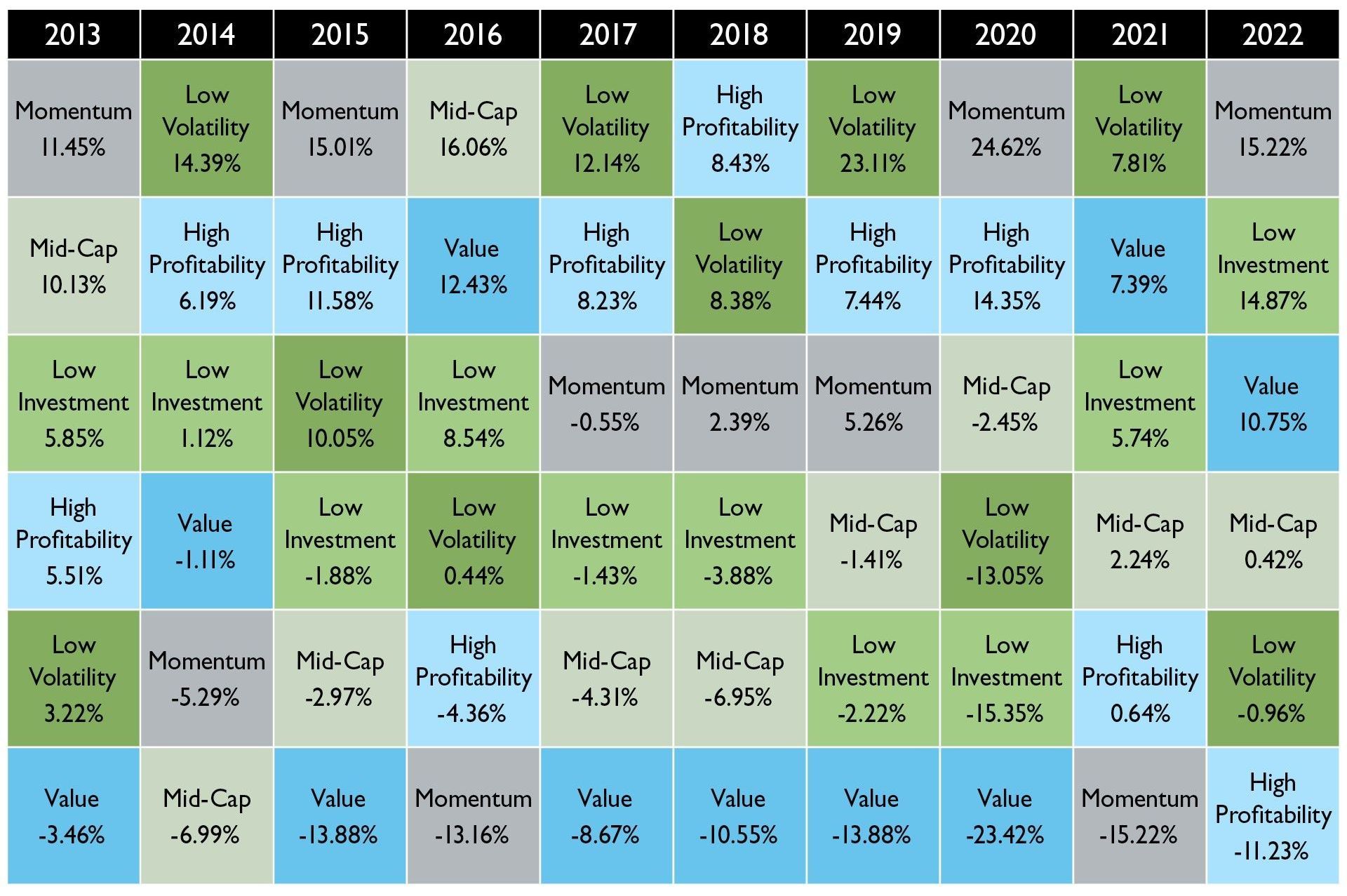

There is no free lunch associated with factor investing. While factor indices have exhibited excess risk-adjusted returns over longer periods, over shorter horizons factors exhibit cyclicality, including periods of underperformance (Figure 2).

Figure 2: Performance Cyclicality of Factors (YoY)

Source: Counsel Portfolio Services

Diversification across factors has historically reduced the length of periods of underperformance by any one individual factor. This is no different from the diversification investors get in their portfolios from different asset classes or geographic regions.

Utilizing Multi-Factor Strategies

In the Counsel Strategic Portfolios, our partner Scientific Beta manages three regional multi-factor strategies: Canada, U.S., and International. The strategies provide us with our desired multi-factor exposure in each of those geographic regions – ensuring that our investors benefit from more effective diversification that is resulting in better performance.

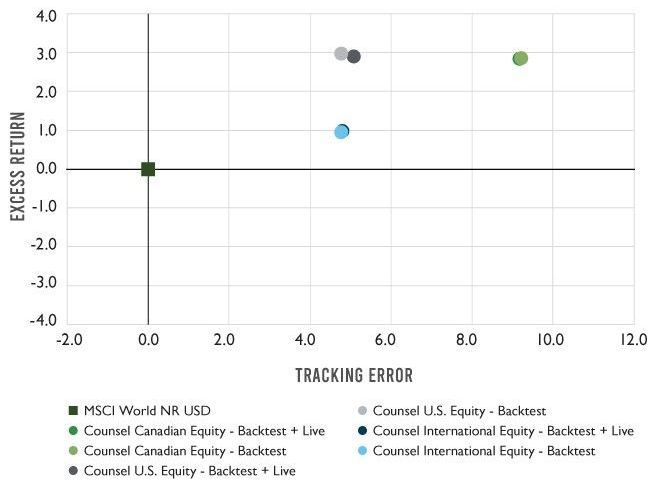

When we combine the multi-factor strategies with our style-based managers, what we’ve seen since November 2019 when we introduced the strategies is the following:

- Across all geographies, composite performance has resulted in superior risk-adjusted performance with a lower standard deviation of returns

- The performance and risk that we have seen are consistent with the back-tested performance

- The results continue to deliver a portfolio with enhanced risk characteristics and increased exposure to long-term reward factors.

- The portfolios have a more balanced risk factor exposure and a greater diversification of those exposures. This is far and above what could be achieved through diversification across traditional active strategies.

Figure 3: Factor Investing – Risk vs Reward

Source: Morningstar Direct

Figure 4: Factor Investing - Excess Returns

Source: Morningstar Direct

Figure 5: Factor Investing – Tracking Error

Source: Morningstar Direct

Conclusion

Our current research indicates that we can obtain a higher long-term return compared to a market cap-weight index from investment strategies that tilt toward these six most rewarded factors. Second, we're getting more effective diversification with these strategies as we're no longer reliant on a single strategy to drive performance in any one market environment. Lastly, employing the multi-factor strategies enhances the risk-adjusted performance of the portfolios as we're also ensuring that our exposure to unrewarded risks is lessened. All in all, the addition of the multi-factor strategies improves the resilience of our Counsel Strategic portfolios, improving the probability of success for these investment solutions going forward.

Corrado Tiralongo

Chief Investment Officer

Counsel Portfolio Services

Counsel Portfolio Services | IPC Private Wealth

Click Here to Read Our Forward-Looking Statements Disclaimer

Investment Planning Counsel